How Do You Record Depreciation

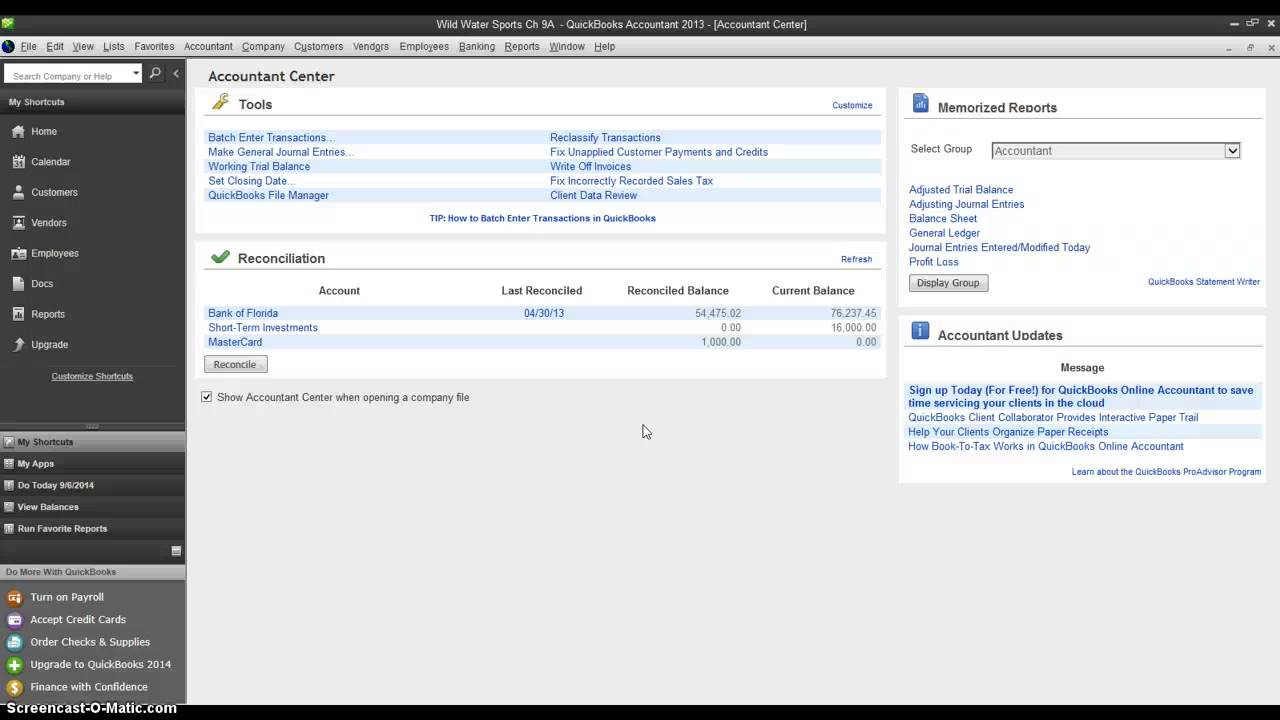

Recording depreciation expense for a partial year Quickbooks depreciation journal entry general Is depreciation an expense? is ebitda deceitful? well, it depends

Recording Depreciation Expense for a Partial Year

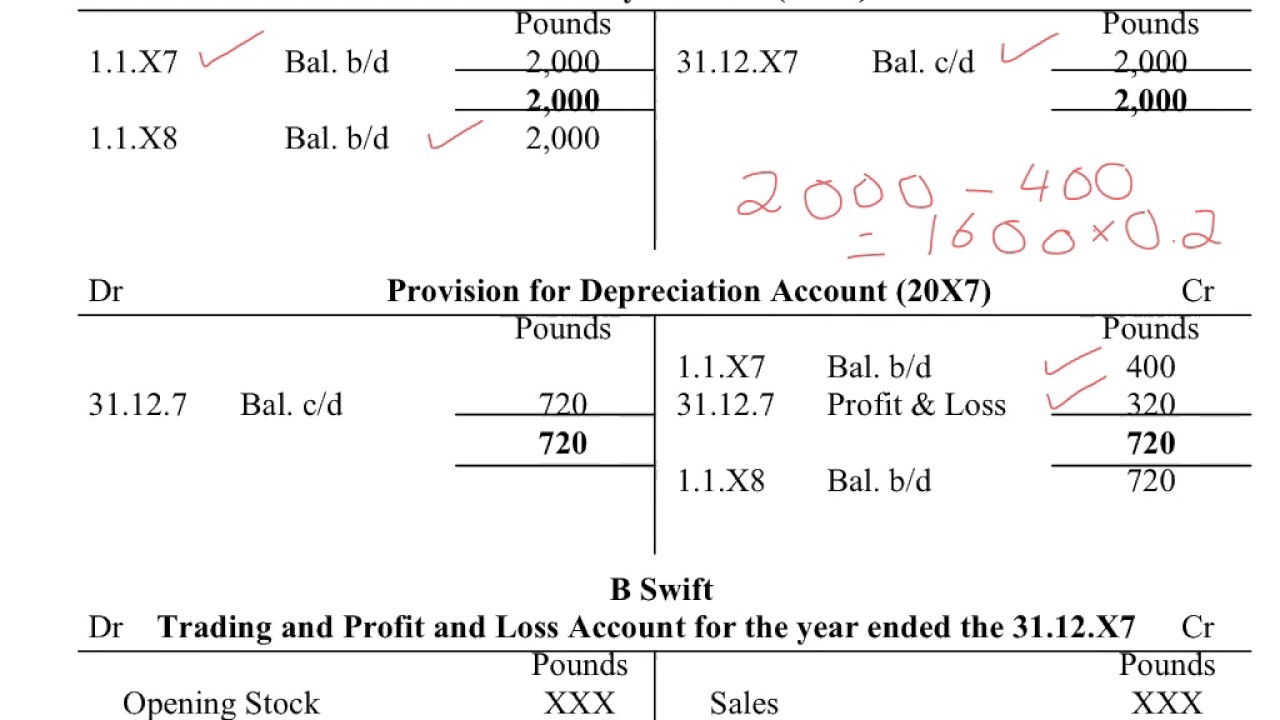

Recording depreciation expense for a partial year Depreciation accounting expense value asset methods method types financial definition finance any impact salvage its business efinancemanagement income used management Depreciation journalize expense accounts accounting entry entries machinery implies

Why is accumulated depreciation a credit balance?

Depreciation journal entryDepreciation general journal entry in quickbooks Journalize depreciationDepreciation sale building expense recording partial year loss accumulated gain figure accounting libretexts debit.

Sample income statement with bad debt expenseDepreciation expense transaction debt Entry journal depreciation expense wages accrued accumulated payable debit adjusting accounting income account closing credit entries summary vs example examplesDepreciation expense ebitda deceitful depends.

Depreciation accumulated investopedia jiang

Depreciation year asset expense sale financial accumulated building accounting equipment recording property partial journal business entry account entries wasting example .

.

Recording Depreciation Expense for a Partial Year

Recording Depreciation Expense for a Partial Year

Journalize Depreciation | Financial Accounting

Sample Income Statement With Bad Debt Expense - Sample Site k

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why is accumulated depreciation a credit balance?

Depreciation general journal entry in QuickBooks - YouTube

Depreciation | Definition, Types of its Methods with Impact on Net Income